All The Major Issues An Individual About Foreign Exchange Trading

All The Major Issues An Individual About Foreign Exchange Trading

Blog Article

There are no sources from which we can predict what the gold price trend 2011 will be. By looking at the historical data an investor can get an idea regarding the price. To know the price estimate of gold in 2011, an investor has to look for the highest gold rate that was recorded in the past. The peak price of gold can reach $5000 per ounce as per the analysts as the current economic output is many times greater than 30 years ago. As today's market is based on trader's emotions and mass psychology many would not believe that the gold price may increase to $5000. Because of this normally the predictions made by different analysts will be different.

Because of underlying fundamentals of the market, for instance the Fed trying to lower interest rates to stimulate the housing market, it seems much more likely interest rates will break through the 4.75% low once they arrive there. If they do a Ethereum price prediction 2026 new downward trend will be on the way. Just how much lower interest rates could get, is anybody's guess. However, it certainly isn't out of the question we could see 4% 30-year fixed mortgage rates sometime before this downward trend ends.

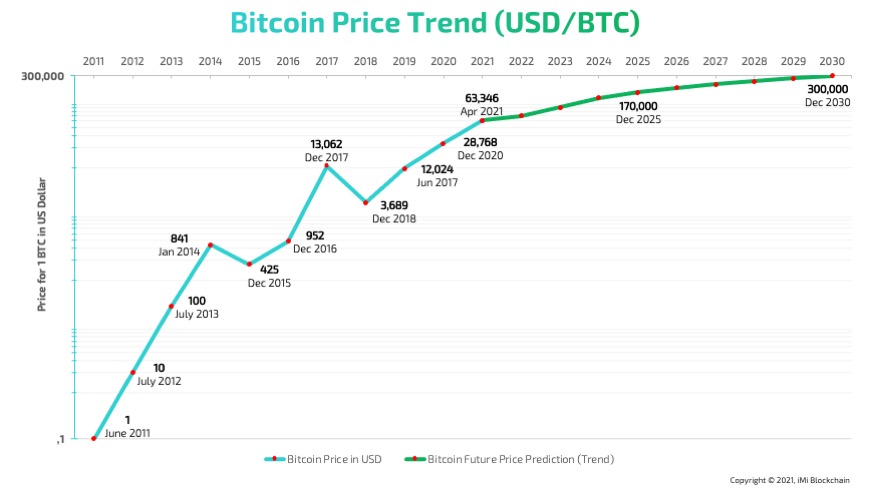

According to the study conducted by the Brookings Institute Austin is among the Top best performing metropolitan area in the second quarter of as said the report published Bitcoin price prediction 2025 in Austin Business Journal.

"It's been going down," Paul replied. "Correct, Dogecoin price history and future trends which way have you been trading this market that has been in a clear TON Price History down trend?" Peter continued. "I haven't been trading it at all, I've just been fully invested, losing money," Paul replied.

When the variables presented in a chart are not all within the control of the viewer, there is a lack of focus. If you can't change a variable, why show it?

So let's ask each question and talk about the real answers. For the sake of this discussion, let's first assume that the Realtor we are talking about here is an experienced agent that sells more than 12 homes per year. Why is that important? Because over 80 percent of Realtors sell 3 or fewer homes per year and cannot truly make any of the arguments listed above. How can they? The agents that only sell 3 homes per year have to relearn the business on almost every deal. This is true across the industry. There are too many "part-timers" for these arguments to be a blanket statement for every Realtor.

He was still apprehensive, but he had a chance to put things right for his family. He was determined to make it as a trader, and with Peter's help, he felt he could indeed succeed...